Your verification needs, satisfied.

Get the proof of identity and active insurance coverage you need.

Protect your dealership. Ensure compliance.

And streamline your business operations.

Bring enterprise-grade security to your dealership with CLEAR embedded directly into Gather, verifying customer data instantly—while Gather simultaneously validates insurance. For a vast number of car buyers, it’s as simple as providing a phone number, taking a selfie, and scanning their insurance card. New users enjoy the same ease after a quick one-time setup.

Once complete your CRM/BDC/DMS is immediately populated with customer data and links to necessary documents.

Here's How It Works:

Step One

Your dealership representative initiates Gather.

Using the Gather Kiosk or Workstation, your sales representative initiates the technology and completes a short verification process with CLEAR, embedded directly into Gather.

Step Two

The customer completes a quick verification process.

For customers already in the CLEAR network, the process takes about a minute—enter a phone number, take a selfie, confirm contact information, and take a photo of their insurance card. New users complete just a few additional steps. From there, Gather, secured by CLEAR, works behind the scenes using biometric data and proprietary inputs to verify identity and connects digitally with the insurance carrier to confirm coverage.

Step Three

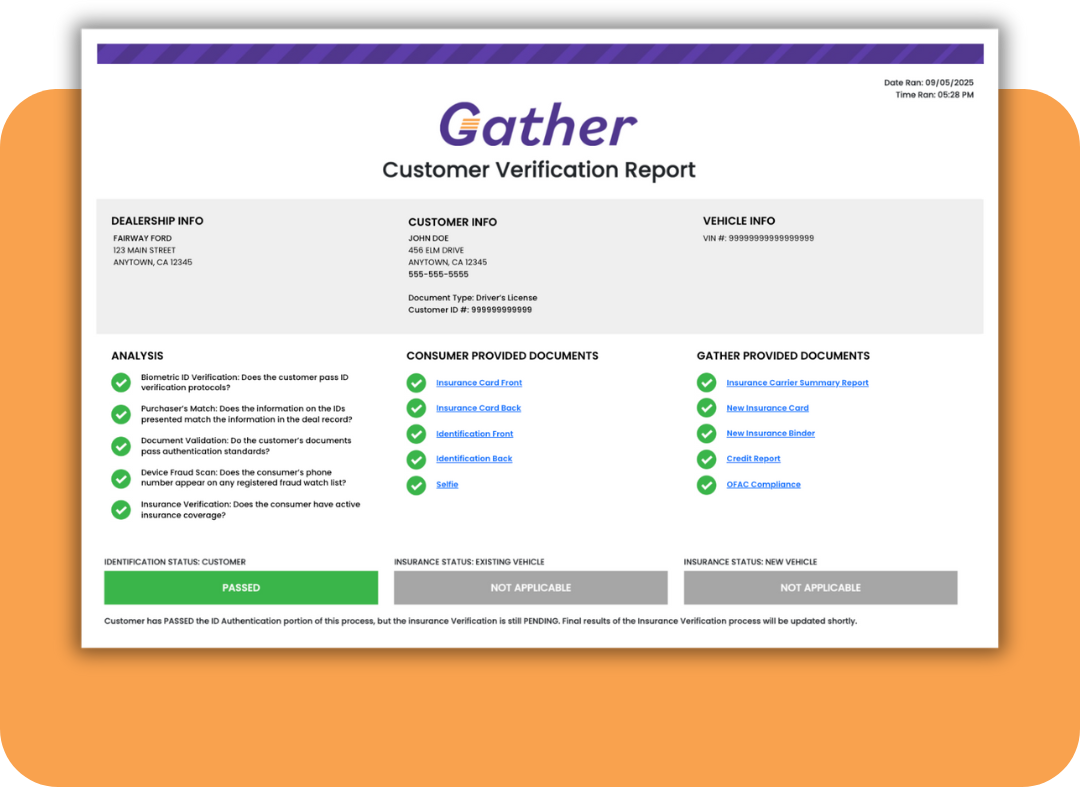

You review the results and your systems are automatically updated.

Your dealership receives a report with the insight needed to determine the consumer’s fraud risk and active insurance coverage—and your CRM/BDC/DMS is instantly loaded with accurate customer information. Here’s what you get instantly:

✔ Contact Information

✔ OFAC Compliance

✔ Identity Verification

✔ Driver’s License Verification

✔ Auto Insurance Validation

Gather integrates natively with leading DMS systems.

We can even update your customer's existing auto policy for you so you can focus on what you do best: selling vehicles.

-

The process is simple.

No long, drawn-out intake forms. Just the policy your customer already knows and trusts updated quickly and securely.

-

The time savings is substantial.

Each policy update by Gather saves an average of 15 minutes of work. Multiply that by the number of cars sold, and it frees up significant time for your team to focus on selling more vehicles.

-

The competition is diminished.

With Gather, no longer will your customers have to engage with competitive agents while in the dealership - keeping them focused on the F&I products your dealerships sells.

-

The compliance is baked in.

By joining Gather, you'll enhance your dealership's compliance with the Safeguards Rule, satisfying the June 9th, 2023 deadline for auto dealerships to comply.

But what if the customer doesn't have insurance?

You can offer them an On-Demand Auto Insurance policy, backed by one of the 10 largest A-rated insurance carriers, available immediately.

Program Overview:

Purchase Program - Standard

Key Features:

-

Verify consumer's identity and active insurance coverage at the point of test drive or purchase.

-

Offer On-Demand Auto Insurance (optional).

Purchase Program - Enhanced

Key Features:

-

Verify consumer's identity and active insurance coverage at the point of test drive or purchase.

-

Automate the update of insurance with the new vehicle being purchased.

-

Secure updated insurance documents for the new vehicle (optional).

-

Enable vehicle delivery without in-hand insurance documents via the Gather Guarantee: Policy (optional).

-

Offer On-Demand Auto Insurance (optional).

Loaner Program

Key Features:

-

Verify consumer's identity and active insurance coverage at the point of borrowing a loaner vehicle.

-

Offer loaner car insurance for underinsured drivers (optional).

We put our money where our mouth is.

Eliminate fraud from your dealership with Gather or we'll cover your losses up to $1 million.*

*If your car buying customer passes Gather’s identity and insurance verification and turns out to be a fraudulent consumer resulting in the theft of a vehicle, Gather will reimburse your dealership up to $299,999 MSRP per incident and $1,000,000 in aggregate.

"As a high-volume dealership, having a dependable process we can use with every customer to prevent fraud and reduce administrative risk has been invaluable."

Dealers across the country choose Gather

Let's talk.

We'd love to have a conversation about how Gather can help meet your needs. Schedule time with us today to learn more.